The Importance of Interest Rates in South Africa

Interest rates play a pivotal role in shaping economic stability and growth. In South Africa, the South African Reserve Bank (SARB) is tasked with regulating these rates to maintain price stability and foster economic growth. With inflationary pressures and economic recovery post-pandemic, understanding the fluctuations of interest rates has never been more relevant for businesses and consumers alike.

Current Trends and Recent Changes

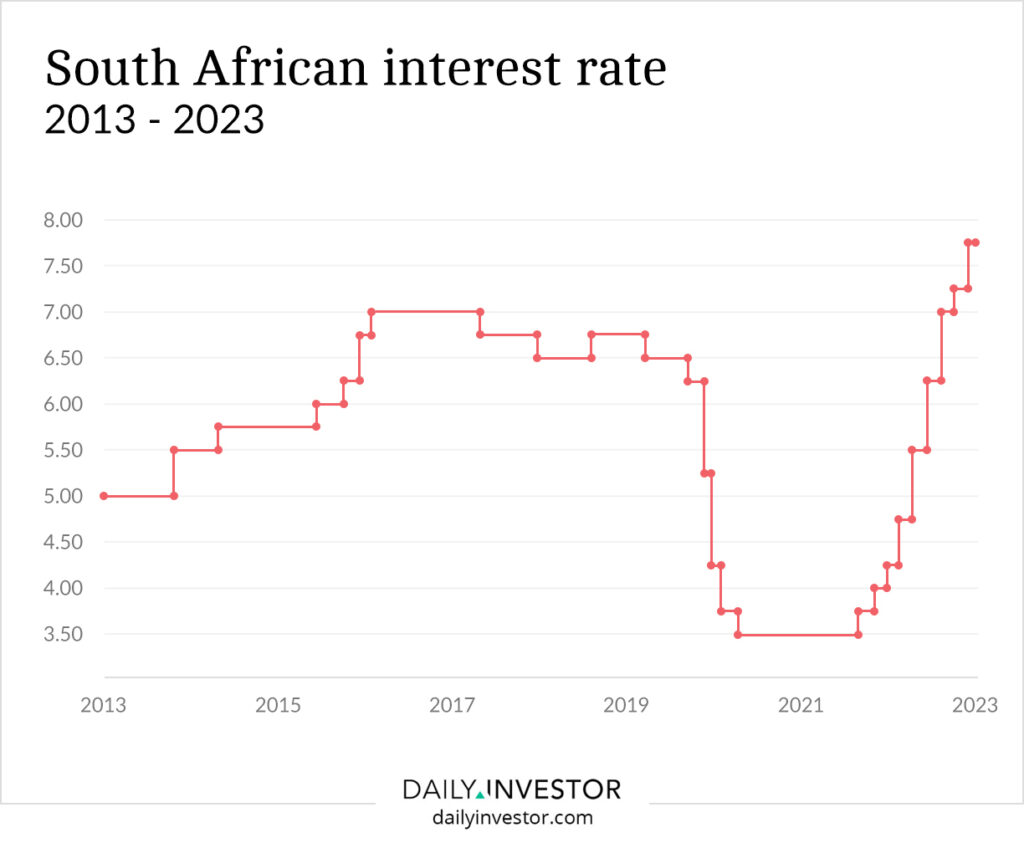

As of October 2023, South African interest rates stand at 7.25%. This rate has been adjusted in response to rising inflation rates, which reached 6.9% in the past quarter. The decision to maintain or alter interest rates is made during the Monetary Policy Committee (MPC) meetings held by the SARB, with the latest meeting indicating a cautious approach to further hikes due to the potential impact on consumer spending and economic recovery.

The SARB’s mandate focuses on targeting inflation rates between 3% and 6%. Given the pressures from global economic conditions, including fluctuating energy prices and supply chain disruptions, the SARB is faced with balancing the need to control inflation while promoting economic growth. The current interest rates affect various sectors, especially housing and consumer credit, making it essential for citizens to stay informed about future changes.

Implications for the Economy

The high-interest rates have significant implications for the South African economy. Businesses may face higher borrowing costs, making expansion or investment more challenging. For consumers, increased interest rates translate to higher loans and mortgage repayments, which can lead to reduced disposable income and spending.

According to financial analysts, the SARB may remain vigilant in their approach, considering global economic trends and local inflation statistics. Some forecasts suggest that if inflation persists above the target rate, further hikes could be implemented early next year, while others believe we may see stabilisation in mid-2024 if inflation subsides.

Conclusion: Future Outlook

As we move through the latter part of 2023, the focus on South African interest rates will continue to be a critical economic factor for stakeholders. As citizens and businesses seek to navigate this fluctuating environment, staying informed will be crucial to making sound financial decisions. The impacts of interest rates will echo through investments, housing, and consumer spending – areas that are vital for the overall health of South Africa’s economy.