The Importance of Brent Oil

Brent crude oil is a key global oil benchmark used to price two-thirds of the world’s oil. Its relevance stretches beyond just the oil market; Brent prices influence the economies of oil-exporting countries and impact consumer pricing for fuel. As 2023 progresses, the oil markets are experiencing significant fluctuations driven by various geopolitical and economic factors.

Recent Trends in Brent Oil Prices

As of October 2023, Brent crude prices have shown notable volatility. Recent data indicates that Brent oil has reached prices upwards of $100 per barrel for the first time since the pandemic began. This surge has been largely attributed to numerous supply constraints, including ongoing geopolitical tensions in oil-producing regions and OPEC+ production cuts.

Geopolitical Factors

The ongoing conflict in Ukraine and tensions in the Middle East have put additional pressure on global supply chains. Sanctions against Russia, a major oil supplier, have restricted its ability to export, tightening the market further. Analysts indicate that these factors combined with seasonal increases in demand—particularly in Europe as winter approaches—contribute to the rising prices.

Market Responses

In reaction to these trends, major oil consumers, including the United States and European nations, are considering strategic reserves releases to stabilize prices. In the past month, discussions surrounding a potential release from the U.S. Strategic Petroleum Reserve have gained traction as officials aim to curb inflation pressures linked to high fuel costs.

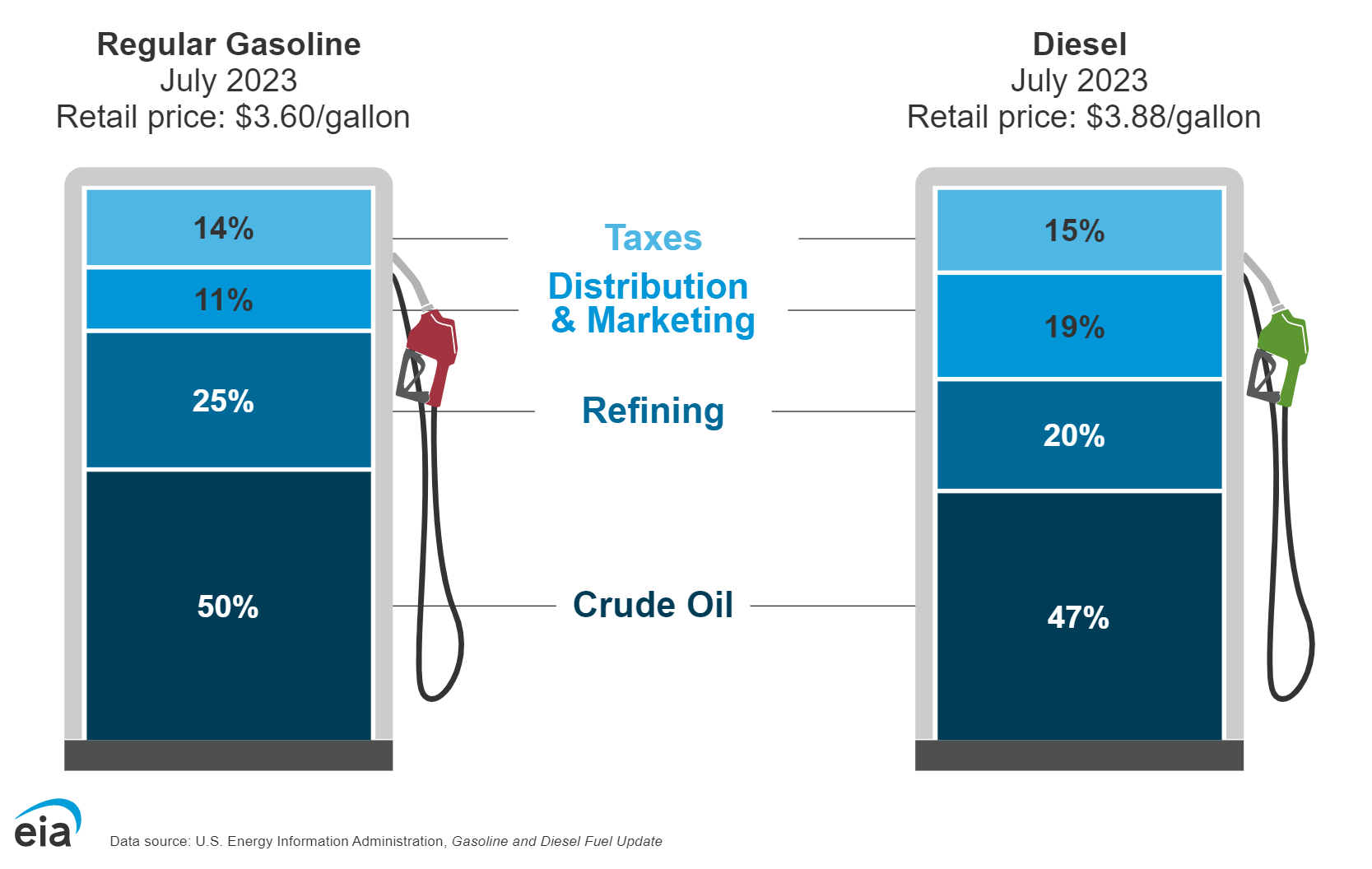

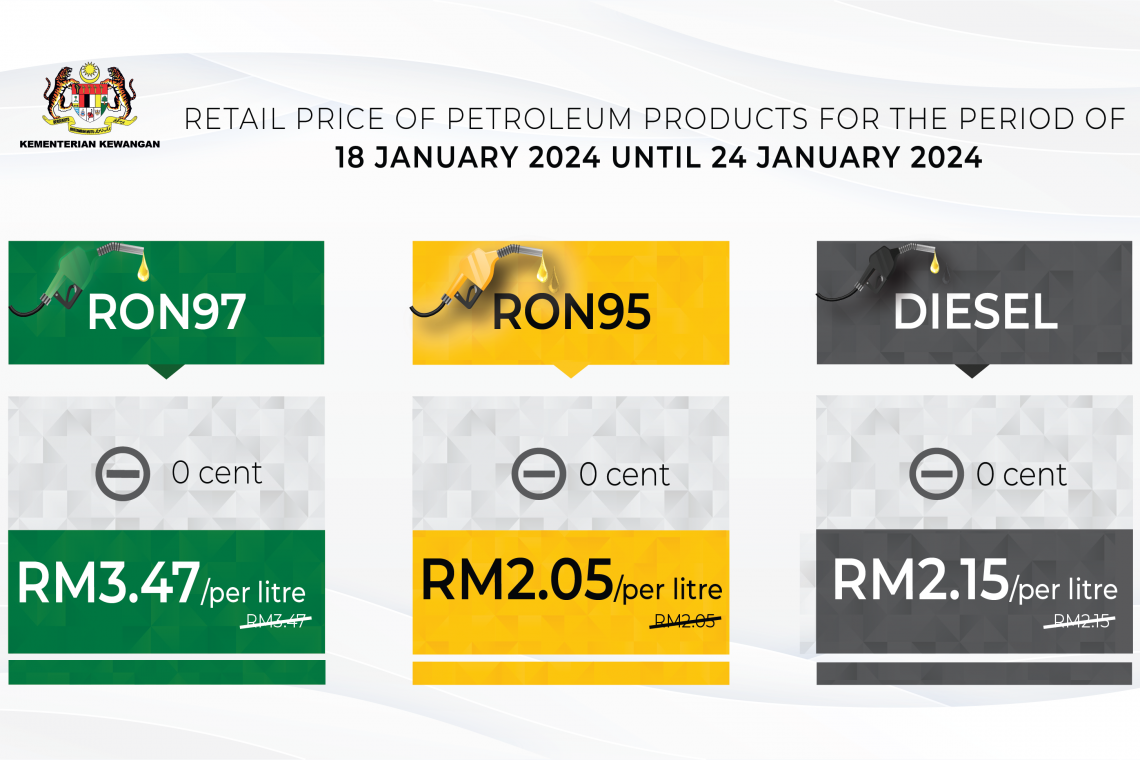

Economic Implications

The increase in Brent oil prices has comprehensive ramifications for both global economies and consumers. Higher oil prices can lead to increased transportation and production costs, which ultimately trickle down to consumers through higher prices for goods and services. Economists warn that if Brent prices remain elevated, it could impact economic recovery efforts in post-pandemic scenarios.

Conclusion and Future Outlook

Anticipating future movements in Brent prices remains challenging due to the unpredictable nature of geopolitical events and market dynamics. Analysts foresee a potential for stabilization should OPEC+ members reconsider their production strategies or if there are breakthroughs in diplomatic negotiations. For consumers and investors alike, remaining informed about these trends is essential as the implications of Brent oil prices will continue to resonate across economies globally.