Introduction

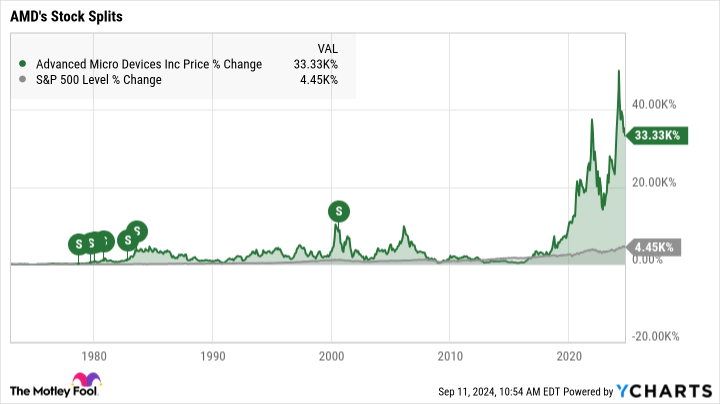

The share price of Advanced Micro Devices (AMD) is a focal point for investors and analysts following the semiconductor industry. This company, known for its competitive processors and graphics cards, plays a significant role in the technology sector, influencing trends and stock performance globally. Understanding AMD’s share price movements can provide insights into broader market sentiments, especially amid evolving technological demands and economic shifts.

Recent Performance of AMD Shares

As of October 2023, AMD’s share price has seen fluctuations in response to various market factors. Over the past year, AMD’s share price reached a peak of approximately $125 in July, driven by strong sales in its Ryzen and EPYC processors, which have gained traction in personal and enterprise computer markets. However, recent dips have seen the price stabilize around $95 due to broader concerns about global supply chain issues and inflationary pressures impacting the semiconductor industry.

Market Influences

Several key factors have influenced AMD’s share price in recent months. Notably, the ongoing competition with rival Nvidia in the graphics processing unit (GPU) space has created volatility. AMD’s recent announcements regarding new product launches aimed at the gaming and data center markets promised to strengthen its position, yet investor sentiment remains cautious amid forecasts of reduced earnings in the forthcoming quarters due to decelerating demand in certain segments.

Forecast and Significance

Looking ahead, analysts suggest that the share price of AMD could experience a resurgence as market conditions stabilize. The company’s focus on artificial intelligence and machine learning applications, alongside potential partnerships and acquisitions, could bolster its bottom line and, subsequently, its share price. Furthermore, analysts predict that as the economy recovers, consumer and business spending may lead to increased sales of high-performance computing products, benefitting AMD. A consensus among investment consultants indicates that AMD remains a strong long-term investment despite short-term volatility.

Conclusion

In conclusion, the AMD share price is an essential indicator of both the company’s health and the broader technology market dynamics. Investors should remain informed about market trends, company performance, and competitive landscape as they assess AMD’s future. With promising technologies and a strategic roadmap ahead, AMD’s position in the semiconductor industry keeps it at the forefront of investment conversations.