Introduction

The share price of Tesla Inc. has been a focal point for investors and market analysts alike, reflecting the electric vehicle manufacturer’s growth, challenges, and market dynamics. As one of the most valuable automakers globally, fluctuations in Tesla’s share price can have significant implications for both the automotive industry and the wider stock market.

Recent Performance

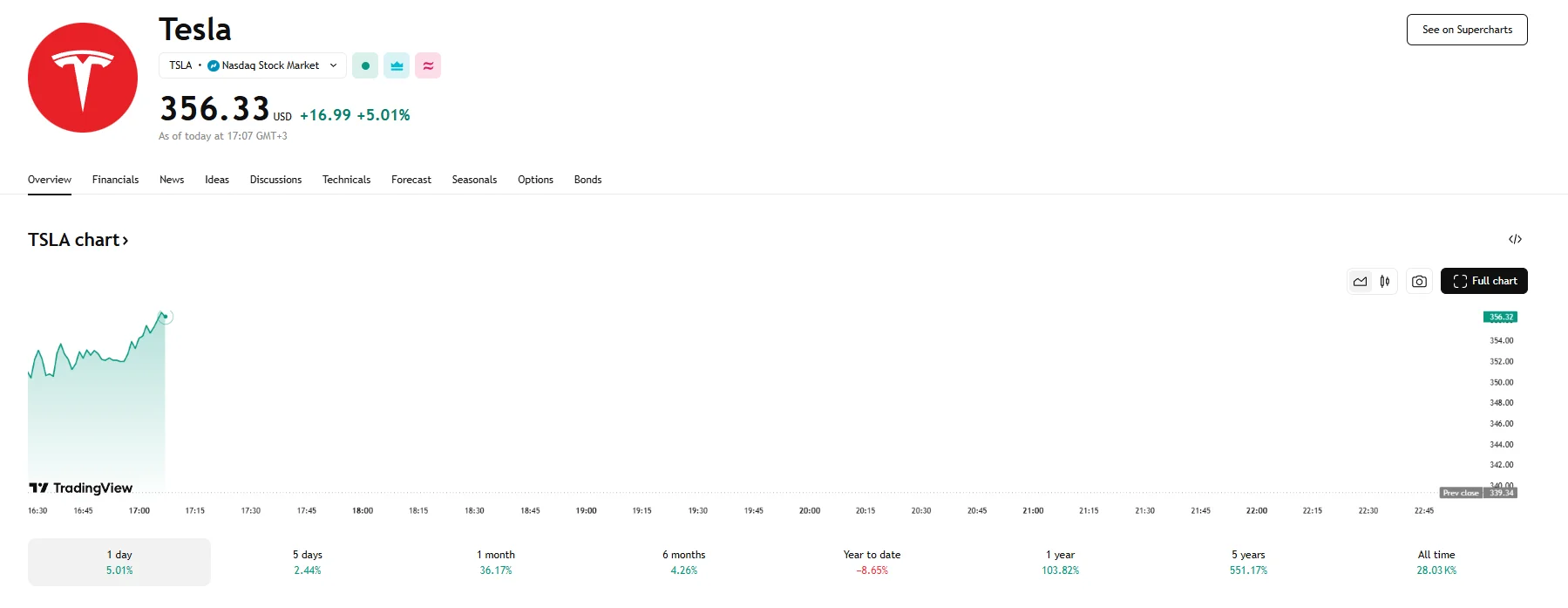

In recent weeks, Tesla’s share price has experienced notable volatility. As of September 2023, Tesla shares traded at approximately R1,600, marking a decrease from the previous highs of R1,800 earlier in the summer. This drop can be attributed to a combination of factors, including broader market conditions, changes in interest rates, and updates on production capabilities in its factories.

Investors have reacted to the company’s production numbers as well. Reports indicated that Tesla produced over 400,000 vehicles in the second quarter of 2023, showcasing its ability to sustain a high production rate. Despite these encouraging figures, investors remain cautious, given the increasing competition from traditional automakers and new entrants in the electric vehicle market.

Factors Influencing the Share Price

Several elements are influencing Tesla’s share price trajectory:

- Market Competition: The rise of competitors, such as Rivian and Lucid Motors, poses a substantial challenge to Tesla’s market share, leading some investors to reevaluate the company’s growth prospects.

- Supply Chain Issues: Ongoing global supply chain disruptions have affected production timelines and costs, causing concern among shareholders about future profitability.

- Policy and Regulation: Changes in government policies regarding electric vehicles can either bolster or hinder Tesla’s market position, consequently impacting its share price.

Conclusion

The outlook for Tesla’s share price remains complex and multifaceted. Analysts are divided, with some predicting a rebound in the coming months as production ramps up and demand for electric vehicles continues to grow. Others warn that without overcoming significant competitive and operational hurdles, Tesla could see further challenges ahead.

Investors are encouraged to stay informed about market trends, regulatory changes, and production updates, as these will be crucial in determining Tesla’s share price direction in the face of an evolving automotive landscape. For those considering investment, thorough research and strategic timing will be critical for capitalizing on Tesla’s ongoing journey.