The Significance of Gold Price

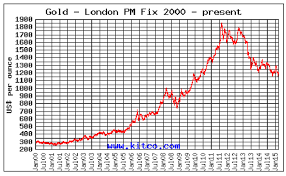

The price of gold holds immense importance in the global economy, acting as a barometer for investors and market analysts alike. As a safe-haven asset, gold often sees increased demand during times of economic uncertainty. The fluctuations in gold prices can significantly impact investment strategies, currency valuations, and inflation rates globally. As of October 2023, the gold price trends demonstrate key movements influenced by geopolitical events, monetary policies, and market demands.

Current Market Dynamics

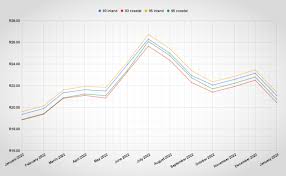

As of mid-October 2023, gold is priced at approximately R1,890 per ounce. This is a notable increase of 5% from the previous month, where it was trading around R1,795 per ounce. Factors contributing to this surge include rising inflation rates in the United States and Europe and the recent geopolitical tensions in Eastern Europe and the Middle East. Investors are continuously turning to gold as a hedge against currency fluctuations and inflation, which has contributed to the recent price upsurge.

Geopolitical Influences

The ongoing conflict in various regions around the globe has been a significant driver for gold prices. When conflicts escalate, uncertainty ensues, prompting investors to secure their assets. Analysts cite that the instability in resource-rich regions has strengthened gold’s appeal, pushing more investors towards this traditional safe haven. Additionally, central banks around the world have increased their gold reserves in a bid to stabilize their currencies, driving further demand.

Outlook and Forecasts

Looking ahead, analysts predict that gold prices may continue to fluctuate based on upcoming economic reports and central bank announcements. If inflation continues to rise without signs of monetary policy tightening, we may observe further increases in gold demand. However, any significant strengthening of the U.S. dollar could counteract gold prices, as the two often have an inverse relationship.

Conclusion

The price of gold in October 2023 reflects a confluence of market forces, geopolitical tensions, and investor sentiment. With rising inflation and ongoing global uncertainties, gold remains a crucial asset for diversification in investment portfolios. For investors, keeping an eye on gold price trends can provide valuable insights into potential market movements and economic conditions. Understanding these dynamics is essential for making informed investment decisions in the current climate.