Introduction

The recent changes to the FNB eBucks rewards program have garnered significant attention from customers and financial analysts alike. As one of the largest banking institutions in South Africa, FNB’s modifications to their loyalty program could affect the banking choices of millions of customers. The eBucks program has been a popular feature, rewarding users for their banking activities, online purchases, and everyday transactions. Understanding these changes is crucial for current and prospective FNB account holders.

Main Body

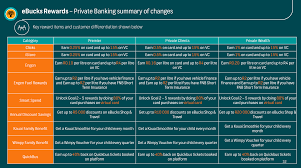

In the past month, FNB announced several key changes to their eBucks program, effective immediately. Firstly, the previous reward structure, which offered points based on the bank’s tier system, has been updated to simplify the way users earn eBucks. Now, customers will earn rewards based on a flat percentage of their qualifying purchases, making it easier for users to understand how many eBucks they can accumulate.

Additionally, FNB has modified the redemption process. Customers can now utilize their eBucks more effectively, with new partnerships allowing for spending eBucks on a broader range of services such as travel bookings, groceries, and even mobile data. This expansion reflects a consumer trend towards flexible and valuable rewards systems.

Moreover, tech-savvy users can rejoice as FNB has enhanced its digital platform to allow for easier tracking of eBucks earnings and redemptions via their mobile banking app. Customers will receive notifications about their rewards status and can instantly see the benefits of their banking activities.

Implications for Customers

These changes have both positive and negative implications for FNB customers. On the one hand, the simplified structure could attract new users seeking straightforward rewards programs. On the other hand, long-time customers may need to adapt to the new earning rates and consider how these changes will affect their loyalty benefits.

Consumer feedback has been mixed. While many appreciate the transparency offered by the flat-rate earning structure, there are concerns regarding potential devaluation if the rates are lower than before. Customers are encouraged to thoroughly review the updated terms and conditions associated with the eBucks program and to assess their benefits on a personal level.

Conclusion

In conclusion, the recent changes to the FNB eBucks program represent an effort by the bank to streamline customer experience while expanding the utility of rewards. As consumers adapt to these modifications, it remains crucial for them to stay informed about how the changes could impact their earning potential. As FNB continues to refine its services in a competitive market, the dynamics of customer loyalty and satisfaction will play an essential role in shaping future enhancements to the eBucks program.