Introduction to Interest Rates in South Africa

The interest rate landscape in South Africa is vital for the country’s economic stability. Interest rates influence consumer spending, borrowing costs, and investment decisions, making it a crucial factor for financial planning. Recently, the South African Reserve Bank (SARB) has made notable adjustments to interest rates, reflecting the ongoing challenges posed by inflation and economic recovery.

Current Interest Rate Trends

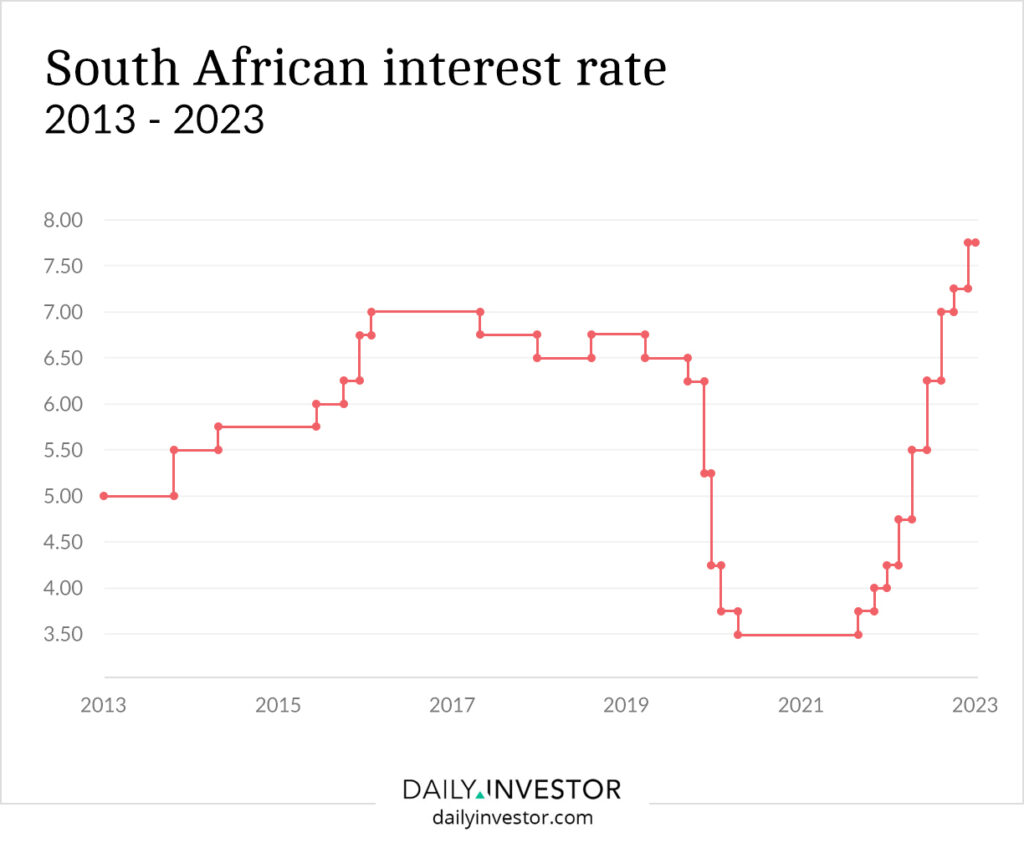

As of November 2023, the SARB has maintained the repo rate at 7.75%, following a series of increases in previous years aimed at combating soaring inflation rates, which hit 7.4% in September 2023. This response aligns with global trends as central banks worldwide grapple with inflationary pressures exacerbated by supply chain disruptions and geopolitical tensions, particularly stemming from the ongoing conflict in Ukraine. As inflation remains above the SARB’s target range of 3% to 6%, the bank’s focus is targeted towards stabilizing prices while fostering economic growth.

Impact on Consumers and Businesses

Higher interest rates directly lead to increased costs for borrowing. Homeowners seeking mortgage approval now face steeper repayments, which, in turn, are negatively impacting the housing market. Businesses also feel the heat as the cost of borrowing rises, leading to tight margins and affecting investment in new projects. The South African Chamber of Commerce and Industry (SACCI) has indicated concern over the rising cost of credit, which could hinder small and medium-sized enterprises (SMEs) from thriving.

Future Trends and Economic Outlook

Analysts predict that the SARB may consider cutting interest rates in early 2024, depending on whether inflationary pressures ease and the economy shows signs of recovery. It’s crucial for consumers and businesses to remain agile during these fluctuating economic conditions to navigate potential changes effectively. As the global economy recovers from recent shocks, South Africa’s monetary policies will play a pivotal role in stabilizing the economy.

Conclusion

Overall, the interest rates in South Africa are crucial indicators of economic health that affect various aspects of financial management. Keeping abreast of changes in the repo rate and understanding their implications will be essential for consumers, businesses, and investors alike as they navigate this complex landscape.